In 2022, the German Development Cooperation (GIZ) contracted Khulisa to provide monitoring and evaluation (M&E) services for Employment and Skills for Development (E4D) – a program that supports public- and private-sector cooperation to bring people into jobs and improve employment situations – in South Africa. The M&E services Khulisa provided aimed to collect baseline data, support monitoring and reporting activities, and conduct a summative evaluation.

The second phase of the E4D program in South Africa supported seven grantees representing a diverse range of industries, from agriculture to animation. Since the COVID-19 pandemic struck in the middle of the program’s implementation, all the organizations and beneficiaries involved had to pivot in many ways. In addition to the general M&E services described above, Khulisa conducted several studies to evaluate COVID’s impact on the E4D grantees. One of these studies was a resilience study of SaveAct savings groups.

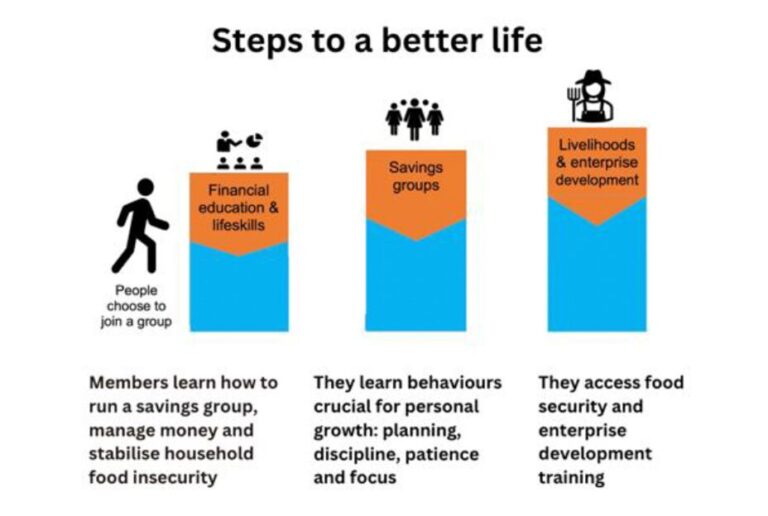

SaveAct seeks to address poverty in South Africa through its support of savings groups: groups of individuals who come together to save and grow their money. Savings group members use the money they save not only for living expenses, education, etc., but also to start income-generating endeavors like vegetable gardening, chicken rearing, sewing, beauty salons, and other small businesses. The pandemic presented an unexpected opportunity to measure savings group members’ resilience in the face of this unexpected shock.

The study measured the resilience of savings groups and their members in a number of ways – financial, social, and environmental, among others – and also assessed how SaveAct savings groups are contributing to South Africa’s just transition framework. The just transition emphasizes equitable economic transitions as the country moves toward an environmentally sustainable future.

Evaluator Tamar Boddé-Kekana, who oversaw the E4D project for Khulisa, explained why the time was right for a resilience study. “SaveAct was interested in the resilience of the groups during COVID because these were savings groups that would meet in-person, and were very strong, and gave in-person facilitation and training. To go through a period like COVID-19 – when they weren’t able to meet in person – they wanted to know what the effects of not meeting in person were and how SaveAct could try to build resilience of groups for future shocks. So that if factors out of their control occur again, they know what they can do about it.”

The Resilience Study

The evaluation included 33 savings groups based in urban, peri-urban, and rural areas of three South African provinces. The team collected data using focus group discussions and semi-structured interviews, and the data were analyzed using a thematic analysis methodology.

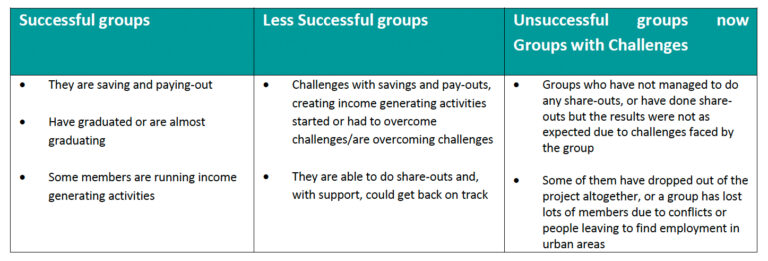

Based on the data collection and analysis, the savings groups were divided into “successful”, “less successful”, and “groups with challenges” categories. The findings showed a significant difference in resilience between the most successful and least successful Savings Groups.

“[Khulisa evaluator Wendy Dube] did an amazing job in finding out success levels of the different groups and how that translated into their resilience,” said Tamar. “What can we learn from the situations in which groups that disbanded were in? And what can we learn from situations in which groups that were doing so amazingly that people not only saved money and used these savings [during COVID-19], but they actually started businesses themselves and are employing others as well? What are the sorts of the success factors for those things?”

Khulisa’s analysis showed several factors that contributed to savings groups’ resilience during the COVID-19 pandemic:

- The range of financial services provided by the savings groups, including financial contributions, buying shares, and interest-bearing lending, offer members a platform to access essential financial resources for investing in their household’s educational, social, and economic livelihoods, thereby improving their financial stability.

- The pooling of financial resources through buying shares in the savings group forms the basis for financial growth. Through financial lending to members, the interest generated from these loans increases the capital and promotes financial growth and stability for the group and its members.

- Member financial security and lower indebtedness increased as the interest rate of finance borrowed from the savings group remained well below that of larger financial institutions and loan sharks.

- The structure, collaborative nature, and trust between members of the savings groups ensures equitable distribution of finances based on a structured sharing schedule.

The study showed that SaveAct savings groups have emerged as powerful forces contributing to resilience and the just transition framework. The resilience study further highlights how the investment by SaveAct in building strong savings groups before the pandemic contributed to their sustainability and resilience.

Read more about the E4D resilience study on our SaveACT Resilience Study Fact Sheet.